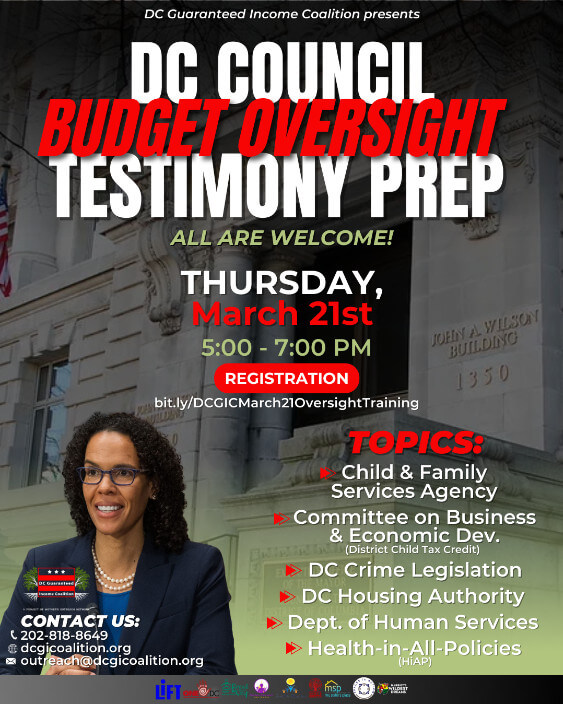

Our Budget Oversight Training is on March 21st!

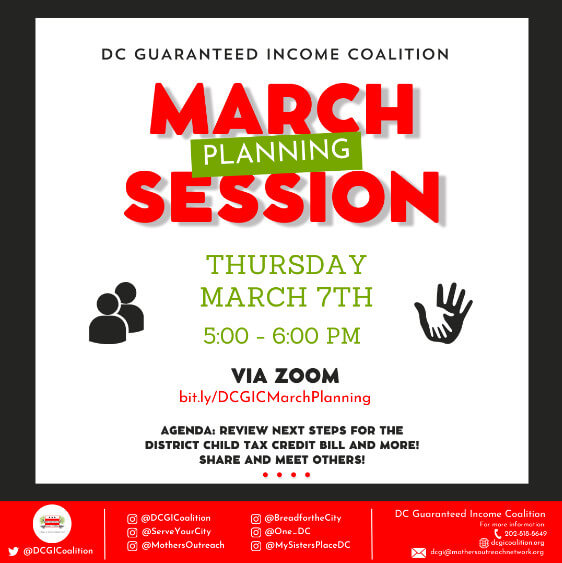

Don’t miss tomorrow’s, Thursday, March 7th planning meeting from 5 to 6pm. Our robust agenda is below, including Ward 5 Councilmember Zachary Parker’s Budget Letter to Mayor Muriel Bowser as it relates to his proposed enhancements to the District Child Tax Credit legislation. Councilmember Parker is the bill’s author and lead sponsor.

Meeting Agenda

- Proposed new DCTC provisions

- DC Council strategy

- Canvassing

- The updated DC GI Coalition platform

- Our March 21st budget oversight training

- Partner Updates

All are welcome to attend! We look forward to seeing you tomorrow! Register here.

In Solidarity

Melody

Melody Webb

Founder and Executive Director

Mother’s Outreach Network / DC Guaranteed Income Coalition

At tomorrow’s meeting, we will discuss Councilmember Parker’s proposals for enhancing the District Child Tax Credit Amendment Act of 2023 as written. The DCTC bill is still pending before the DC Council Business and Economic Development Committee. Let’s push for it to be scheduled for a mark-up! Join us to strategize around next steps!

Councilmember Parker recently remarked in a letter to Mayor Bowser: “To lift children out of poverty, invest in their futures, provide them with the educational and recreational opportunities they deserve, I recommend the following investments:

Reduce child poverty and childcare costs by investing $60-75 million in a District Child Tax Credit. Last year, I introduced the District Child Tax Credit Amendment Act, and I am thrilled that the Tax Revision Commission is in the process of endorsing an even more generous version of this proposal that would provide a fully refundable credit of $1,000 for every child ages 17 and under. This fully refundable credit would be available to most D.C. families and phased out gradually at higher incomes. If passed, the Child Tax Credit will reach nearly 125,000 District youth under the age of 18 while reducing child poverty rates by more than 10%. To fund this proposal, I am advocating that the District move forward with several other proposals advanced by the Tax Revision Commission that exclusively benefit the District’s wealthiest residents, including; (1) taxing electric vehicles at the same rate as other cars and trucks ($20 2 million in additional revenue); (2) limiting the income tax exemption for municipal bond interest to bonds issued by the District ($15 million in additional revenue); and (3) increasing the income tax floor on itemized deductions to at least 7.5% of adjusted gross income (at least $26 million in additional revenue).”

Excerpt from Councilmember Zachary Parker’s February 28, 2024 Budget Letter to Mayor Muriel Bowser.

Finally, to learn more about or to get involved with DC Guaranteed Income Coalition: